Eight Years Car Aftermarket in Europe

Eight years ago, the management consultancy wolk aftersales experts GmbH, which specializes in the automotive aftermarket, published the report “The Car Aftermarket in Europe” for the first time. The industry report outlines market structures, volumes and trends for 35 countries in Europe in a compact and clear way. Much has changed in the market since then. The IAM remains a stable economic factor in most European countries, with a solid growth of 1.6% (2015). But the Independent Aftermarket in Europe now has reached a crossroads.

Facts

The total volume of the European aftermarket amounts to 127 billion euros in 2015 (end-user prices without labor and tax). Germany accounts for 17% of this figure.

European car drivers spent an average of 388 euros on automotive parts in 2015, 3 euros more than in 2014, while in Germany, drivers invested 477 euros, 4 euros less than in 2014.

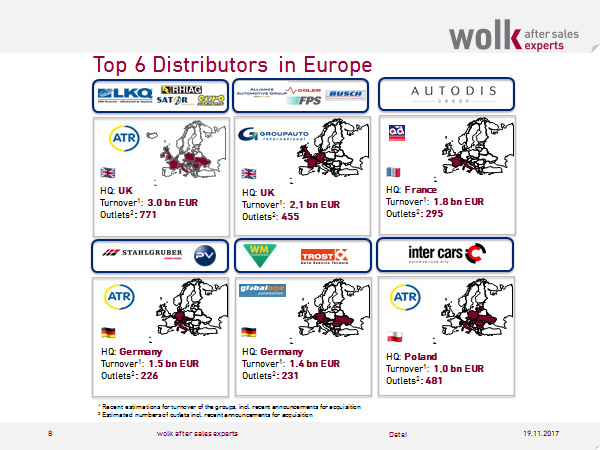

There are 54 parts traders with a turnover of more than 100 million euros in Europe. Overall, the number of car parts distributors in the 35 countries surveyed continued to decrease compared with previous years. This applies primarily to the smaller local parts dealers, whose number is constantly declining. There is no end in sight to this development.

6 parts traders exceed the 1 billion euros in sales, two of which come from Germany, WM and Stahlgruber.

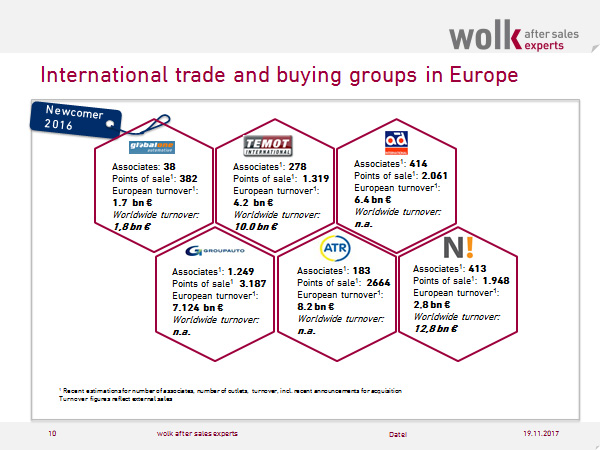

Major international purchasing cooperations such as ATR, Temot, Groupauto International, AD International and NEXUS Automotive International are still able to hold their positions in Europe, facing the growing market power of some of their members. The newcomer among the cooperations, Global One Automotive has also gained 38 members since its foundation in 2016. At the beginning of 2018, another member will join the Northern Irish national purchasing cooperation FG7.

Outlook

The continuous decline of parts dealers is one of the first consequences of the rapid consolidation in the European car parts distribution and the ensuing restructuring of the market. With the increasing involvement of North American companies such as LKQ (USA), Uni-Select (Canada) or Genuine Parts Company (USA) in the European IAM, a different understanding of the market is coming to Europe. For example, the North American market does not have as many distribution levels as the European market and companies like Genuine Parts Company distribute about 90% of their own brands (NAPA).

An increasing share of e-mobility, technological developments, especially in the digital sector, consolidations in the parts trade, the struggle for data sovereignty and political interventions will shake up the foundations of the IAM, even though their impact often only becomes apparent with a delay.

The IAM will have to face these developments. Either way.

Contents of the study „The Car Aftermarket in Europe 2017“:

In „The Car Aftermarket in Europe“, the following market segments were examined on more than 3,000 pages for 35 countries each:

- market volume for 10 product groups (wear parts, body component, aggregates, electrical parts, accessories, car glass, chemicals, oil, tires, paint)

- market shares of the IAM / OES market for the 10 mentioned product groups

- structures of the IAM and OES market with a focus on:

- trade structures (cooperations, distributors, specialist retailers, retail chains, direct marketers, web shops and much more)

- workshop structures according to workshop types and workshop system affiliation

- in addition, company profiles with sales, outlet and contact details of more than 2,000 of the largest aftermarket players in Europe were compiled

The report is based on the After Sales ACCESS database from wolk after sales experts, with more than 8,000 registered companies in Europe.

Country reports are available separately.

More information at:

http://www.wolk-aftersales.com/car-aftermarket-europe-report-market-analysis-automotive-aftermarket.html